Central banks could keep interest rates higher for longer as they fight to curb inflation that remains stubbornly high in many countries—and slow their economies by doing so.

Such an environment hasn’t confronted the world’s financial markets in a generation. That means financial supervisors must sharpen their analytical tools and regulatory responses to address emerging threats. And the new risks gathering in the banking system and beyond mean it’s time to redouble efforts to identify the weakest lenders.

Accordingly, we enhanced our stress-testing tools to focus on risks from rising interest rates and incorporate the kind of funding pressures that toppled some banks in March. We also developed a new surveillance tool for tracking emergent banking fragilities using analyst forecasts and traditional bank metrics. These monitoring tools, based on public data, aim to complement stress tests by supervisory authorities and by IMF-World Bank teams in Financial Sector Assessment Programs, which use more granular confidential supervisory data.

Rising rates are a risk for banks, even though many benefit by collecting higher interest rates from borrowers while keeping deposit rates low. Loan losses may also increase as both consumers and businesses now face higher borrowing costs—especially if they lose jobs or business revenues. Besides loans, banks also invest in bonds and other debt securities, which lose value when interest rates rise. Banks may be forced to sell these at a loss if faced with sudden deposit withdrawals or other funding pressures. The failure of Silicon Valley Bank was a dramatic example of this bond-loss channel.

Stress testing

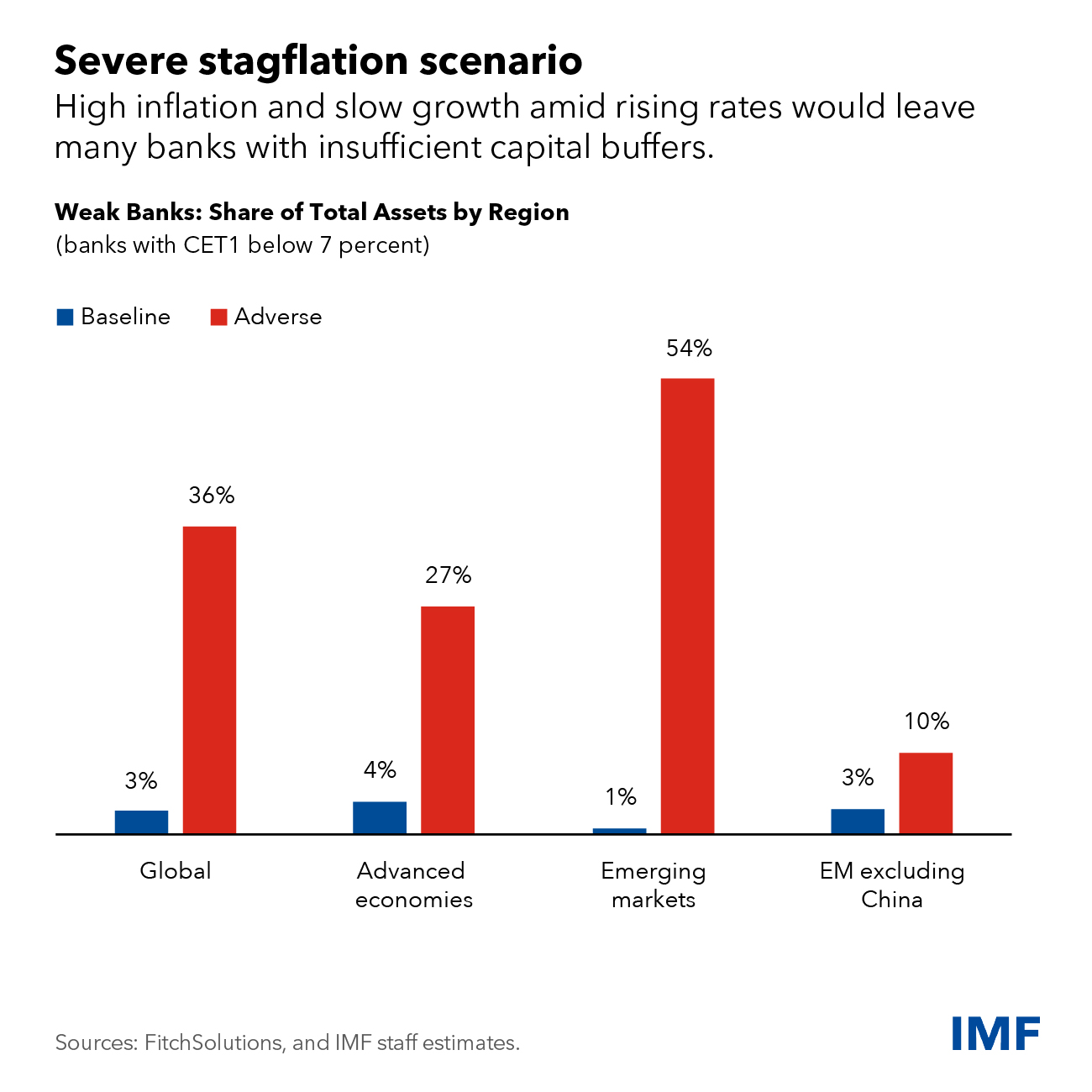

The banking system appears broadly resilient, according to our new global stress test of almost 900 lenders across 29 countries, outlined in a chapter of our latest Global Financial Stability Report. Our exercise, which shows how lenders would fare under the baseline scenario we project in the latest IMF World Economic Outlook, identified 30 banking groups with low capital levels, together accounting for about 3 percent of global bank assets.

But if beset by severe stagflation—high inflation with a 2 percent global economic contraction—coupled with even higher central bank interest rates, the losses would be much greater. The number of weak institutions would rise to 153 and account for more than a third of global bank assets. Excluding China, there are many more weak banks in advanced economies than in emerging markets.

This group of weak banks suffer from rising interest rates, rising loan defaults, and falling securities prices. Importantly, additional analysis shows that losses from selling securities under deposit run scenarios are less painful when banks have access to central bank lending facilities, such as the Federal Reserve’s discount window.

To complement the global stress test, our new surveillance tool incorporates traditional supervisory metrics, such as the ratio of capital to assets, as well as market indicators, like the ratio of the market price to the book value of bank equity. These have historically proven important predictors of lost confidence during banking stress events. It flags banks for further review if they appear to be outliers across three or more of the five risk metrics we consider: capital adequacy, asset quality, earnings, liquidity, and market valuation.

During periods of stress, many banks may show up as potentially vulnerable, while few ever do experience significant distress. Back testing this tool shows a surge of potentially vulnerable institutions at the onset of the pandemic, as well as a sustained rise in late 2022 as higher interest rates began to bite. This latter group included the four banks that either failed or were taken over in March.

Based on current market data and consensus analyst forecasts, these indicators point to a substantial group of smaller banks at risk in the United States, and concern for some lenders in Asia, including China, and Europe as liquidity and earnings pressures persist.

The sizable group of weak banks identified in both exercises underscores the need for new policy measures in the banking sector:

- Stress tests by supervisors should include market-based analysis, include smaller lenders, and test banks against scenarios that are more severely adverse yet still plausible.

- Bank supervisors need to be proactive and stand ready and willing to address identified weaknesses. Our Financial Sector Assessment Program has found that more than half of economies do not have independent bank supervisors with adequate resources.

- International standards need to be raised to keep liquidity and interest rate risks in banks at bay. At least one-fifth of economies have weak supervisory and regulatory practices to monitor and address these risks, and the March turmoil shows why this is such an important issue.

- Banks would be more resilient if better prepared to access central bank lending facilities. Banks should periodically test such access while supervisors assess whether weaker lenders can easily tap the emergency assistance.

Now that banking strains have abated, the institutions and their regulators and supervisors should take this time to increase resilience. And they should prepare for a possible resurgence of these risks, as interest rates may stay higher for longer than currently priced in markets.

— This blog is based on Chapter 2 of the October 2023 Global Financial Stability Report, “A New Look at Global Banking Vulnerabilities.”